SAP License migration: what options do you have to deal with strategic changes?

Public and private companies that have adopted SAP solutions in the past, are now at the crossroads of strategic choices: to continue using SAP solutions by migrating to S/4HANA, to keep old licenses or to find alternatives to SAP products. Figure 1 below shows an overview of possible options that we will further detail in this article.

There are many different triggers specific to each SAP client’s context:

- End of current software support planned for 2027 (or 2030 with maintenance extension rights);

- Different corporate projects (Carve-In/Out, spin-off…);

- Digital transformation projects (move-to-cloud, ERP or CRM change or else…).

IT, Procurement and Business Departments are concerned by all these reflections with the goal to choose the best strategy from performance, budget, and innovation perspective in front of constraints related to inevitable changes.

We would like to give you here a short description of three possible avenues of reflection – depending on your context and based on our experience.

1- Keep your ECC6 license.

This choice might seem not obvious at first glance, especially regarding “innovation” part. ECC6 systems’ features are not as performant as S/4HANA, ones even though some innovation projects could still be possible: for instance, you could use your ECC6 licenses in BYOL mode within your move-to-cloud projects.

We can also find other interesting arguments in favor of this option especially if your SAP products usage is not strategic for your business. If you continue with ECC6 systems, you keep your perpetual usage right of your old licenses including your specific developments (if any). Moreover, your teams and IT budgets remain available for other more strategic projects that would require additional resources to innovate and transform your activity.

Third-party maintenance providers, like Remini Street, might also be an interesting alternative to consider. They could ensure support for a certain range of your SAP software products and modules for an average maintenance cost savings of about 50%. In this regard, you still have a possibility to reactivate your SAP maintenance to perform notably an S/4HANA migration. We observe that SAP does not always apply severe penalties or back maintenance fees unlike some other software publishers. Even though it seems that SAP’s goals are to keep all its clients and to remain competitive against tough competition, their practices should be monitored in the future.

However, keeping your ECC6 systems is not without risks. We have already mentioned very limited innovation benefits. After 2027 (or even 2025 for software packages 1-5) the maintenance extension cost will be increased by 2%. And third-party maintenance providers could not always guarantee 100% coverage of your software landscape.

Above all, you should estimate your future needs for SAP licenses. Indeed, SAP sales teams are no longer incentivized to sell legacy licenses: no generous commercial gestures or even end of commercialization of some old licenses. Following potential organic growth of your company or else due to yearly SAP audits, you could find yourself in quite a delicate situation if such topics are not duly anticipated.

To this extent, the European “second-hand” licenses market is currently developing but it is not yet at Microsoft “second-hand” licenses market level for example.

2. S/4HANA Enterprise Management Migration

You can also opt for SAP products with innovative features of S/4 Enterprise Management licenses. Such perpetual licenses will allow you to be less dependent on the publisher’s policy as opposed to subscription licenses.

S/4HANA migration is an excellent opportunity to renegotiate your licenses volume and other contractual terms with SAP, as well as to fine-tune your infrastructure and SAP products’ needs.

You have a wide range of solutions to deploy S/4HANA products. However, you should pay attention to licensing rules and other specific limitations applicable to each deployment type (inter alia – different metric types for S/4 contracts for perpetual license or subscription) . To this extent, while converting your old ECC6 licenses towards S/4HANA, you may capitalize on your purchased licenses to partially finance the purchase of new S/4 products. Within this operation you terminate your old licenses against a CAPEX credit (to be negotiated) that allows you to amortize costs related to the purchase of new S/4 licenses.

Another option that could be negotiated in 2023 with the publisher, was to keep using your ECC6 “Named User” licenses with S/4HANA features enabled. If SAP is still open to negotiate that migration option in 2024, you can avoid an important additional investment into S/4HANA User licenses conversion, and you can also spare your internal resources on this part of SAP negotiation.

S/4HANA migration is not without risks and challenges for your company. First of all, we remind you that SAP is no longer willing to sell you the perpetual licenses, even S/4HANA ones. Sales teams will not be very flexible to grant you important concessions during negotiation.

The negotiation itself might be quite complex as you will have to manage product conversion whilst trying to:

- purchase licenses in adequacy to you real needs (not too few or too many), and

- limit additional investment into SAP products or into the technical migration project and other related services.

Finally, you should address some specific constraints proper to S/4 contracts. Let’s name two of them that would require your particular attention:

- HANA database: HANA database becomes compulsory, and the only one tolerated by the publisher. SAP clients normally cannot exchange their old MS SQL, Oracle, or other Runtime licenses. Hence, you should buy HANA Runtime or Full Use licenses for your HANA databases.

- Digital Access: there is no more “grey zone” for SAP clients regarding Digital Access licenses with 9 Document types as per Figure 2 below. According to S/4 contracts, SAP clients are clearly obliged to cover their indirect usage of the SAP ERP’s Digital Core - unlike some very old SAP contracts that don’t even have specific wording for indirect usage, leaving a room for negotiation.

Therefore, it is crucial to define internally all these needs in order to gain control over your IT budget within S/4HANA EM migration.

3. Subscription: Move to SAP Cloud

Our third option is to migrate to SAP Cloud solutions, however, it would be first publisher’s choice during your discussions with SAP. There are, indeed, many benefits: quick deployment of the innovative and flexible solutions, competitive costs, and personalized support of SAP clients by dedicated experts all along the usage.

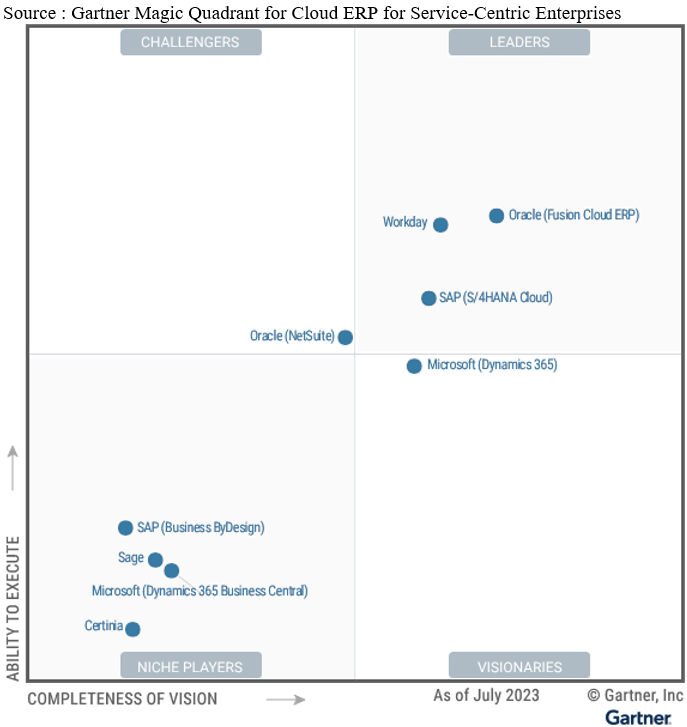

SAP Cloud products have the most recent updates and publisher’s innovative features. Recently recognized as ERP Cloud Leader by Gartner, SAP made the strategic choice to invest especially in their cloud solutions in the future. It means that perpetual S/4 licenses might not get all the updated and innovative features even before 2040 (notably regarding AI or Green IT fields).

You will also appreciate quite a rich choice of SAP Cloud solutions that could meet your expectations for different Business needs: in addition to the “RISE with SAP” offer appeared in 2021, there are other cloud solutions with specific contracts per business field (Ariba, Hybris, Fieldglass, SuccessFactors, SAC, C4C, Blackline…).

If you have an old SAP contract, you could still capitalize on your purchased licenses to reduce the cost of new investment in cloud products. SAP Cloud Extension Policy (CEP) will allow you to exchange your old perpetual licenses against new cloud solutions commercialized under subscription model. You might negotiate within CEP a credit based on the OPEX value of your terminated licenses to finance your first contractual period of SAP Cloud with an initial duration of 3 or 5 years.

Despite all the benefits, be aware of the risks that will be waiting for you, should you opt for an SAP cloud subscription contract.

The first and most obvious risk is that you will abandon your perpetual right to use SAP licenses. That alone will considerably increase your dependency on the publisher, notably regarding unilateral and systematic changes of pricing, license packages, metrics, and licensing rules of SAP cloud products.

Negotiating with SAP is very difficult even if the publisher is more flexible during the negotiation process as you are purchasing the ”score card” solutions. You should be well prepared:

- Upstream: to effectively manage products conversion, CEP credit valorization by SAP as well as to master final costs for cloud solutions notably via a TCO cost assessment, and

- Downstream: to effectively manage the “Run” phase of the SAP Cloud solutions by making sure you have FinOps experts on your side.

Besides, it is not a matter of one but of several systematic negotiations with SAP at each renewal period of your cloud contracts. You should mobilize all your resources to avoid a sharp increase in your IT costs. One of the pain points of SAP subscription contract is a very complex negotiation process - should you wish to decrease your SAP license needs.

Despite appearances, SAP cloud licenses monitoring and optimization are possible notably via SAP Measurement Guides. However, by decreasing the quantity of the subscription licenses to be renewed, you might have an unexpected result. Indeed, SAP doesn’t really allow contractual ramp-downs and the publisher may apply punitive prices that would make your global contract cost even more expensive with lesser quantities of SAP licenses subscribed.

Finally, we should not forget different regulatory and security constraints regarding SAP Cloud migration. This topic is sensitive especially for big private or public companies established in Europe that have been using SAP products for years. Due to the lack of offers from European hyperscalers for SAP solutions, such companies have real concerns about, inter alia, the following topics:

- GDPR compliance;

- SAP policy regarding reversibility of the clients’ data;

- Security level of the SAP cloud environment compared to the certified SecNumCloud environments.

According to USF (French-speaking SAP users association) and Sugen’s (SAP User Group Executive Network) President Gianmaria Perancin, the migration of the installed software base to the cloud should be better defined by the publisher.

Conclusion

Migration projects with respect to ERP, CRM or other resource management solutions of your company are always very complex and expensive. There are multiple issues whilst the IT budgets and internal resources are often quite limited.

However, with well-anticipated negotiation planning and well-prepared list of topics to be addressed both internally and to SAP, the results of such negotiation will meet your strategic expectations and will bring the benefice that Business and IT departments are looking for.

Elée has many experts specialized in different fields of activity and ready to support their clients during migration projects by:

- defining Procurement strategy,

- performing contractual and SAM analysis, and

- suggesting different business cases to help their clients during the decision-making process as well as negotiating the expected results with the publisher.